At this year’s Pacific Telecom Council conference, I invested a long time talking through TeleGeography’s most current rates research study findings and dealing with the most typical concerns we have actually gotten over the previous year.

In case you missed it, here’s a wrap-up of my Taylor Swift-themed discussion: Worldwide Prices Patterns in a New Age

In 2015, we discovered ourselves in uncharted area Hold-ups in brand-new supply had actually significantly slowed cost disintegration around the globe, leaving us to question if rates were in fact increasing.

Are we out of the woods yet? Not totally.

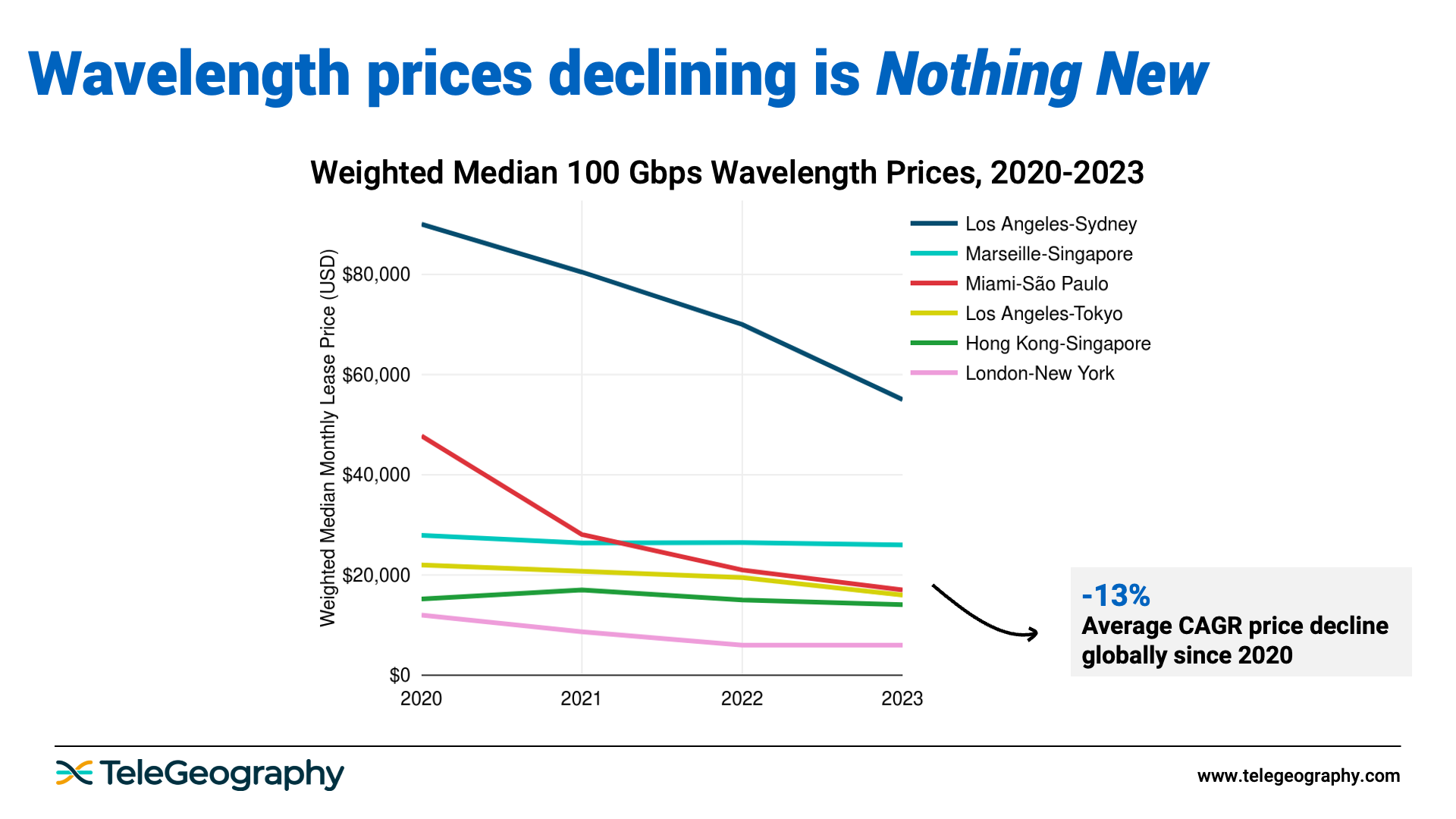

Over the previous 3 years, 100 Gbps rates throughout 6 crucial international paths continued to reduce about 13% typically.

Obviously, we saw a large range in cost disintegration patterns– rates reduced simply 2% on Marseille-Singapore vs. 29% on Miami-São Paulo– however that’s not the huge story here.

Regardless of these decreases, cost disintegration is taking place at a much slower speed than we’re utilized to seeing in the market.

In the figure listed below, we have actually drawn up 100 Gbps wavelength CAGR cost decreases from 2017-2020 (blue-green) and 2020-2023 (dark blue).

As you can see, cost decreases have actually significantly slowed throughout all 6 of these paths. From 2017-2020, we saw a 30% typical decrease. That number minimized to simply 13% from 2020-2023.

There are a couple of elements at play here.

These are really competitive submarine cable television paths, and 100 Gbps rates are currently low. Plus, we’re still seeing hold-ups in brand-new network supply on a great deal of these paths.

Yes, card lacks and supply chain interruptions have actually solved themselves, however geopolitical concerns– such as in the Red Sea and South China Sea– are postponing network tasks.

Less cable televisions with stock at one time has actually caused less competitive cost pressure. Nevertheless, on paths with current upgrades, brand-new supply, and pre-sales on brand-new systems, cost disintegration is going back to greater levels.

On paths with current upgrades, brand-new supply, and pre-sales on brand-new systems, cost disintegration is going back to greater levels.

In the meantime, unpredictability on the timeline of future supply on some paths has actually altered consumer buying patterns.

Supply is being taken up before it appears or purchased wholesale, so even if upgrades are taking place, that capability might currently be promoted. Clients are taking capability at the cost that is provided, which’s assisting to keep cost points.

What about 400 Gbps? How is need for this service forming up, and what are pricing designs appearing like worldwide?

How have these transportation patterns affected the transit market?

In 2015, our information recommended that the supply shortage and inflationary pressure on network devices expenses had likewise soft IP transit cost disintegration. That’s no longer the case.

For more information, download my complete slide deck

In addition to what we have actually currently covered here, these slides reveal the effect of transportation on transit rates and where we’re headed in our next period.