“ Some monetary advisors are asserting that Buffett is discovering it more difficult than ever to discover underestimated business to get.“

Warren Buffett’s business might be resting on a record quantity of money, however that does not always imply the well known financier believes the stock exchange is miscalculated.

It is very important to point this out in order to counter the story that has actually emerged because the current quarterly report from Buffett’s business, Berkshire Hathaway

BRK.A,.

BRK.B,.

Some monetary advisors are asserting that the corporation’s substantial money stockpile– more than $150 billion in money and short-term financial investments, biggest ever in the business’s near-60-year history– suggests that Buffett is discovering it more difficult than ever to discover underestimated business to get. If so, that in turn would indicate that the stock exchange is precariously miscalculated.

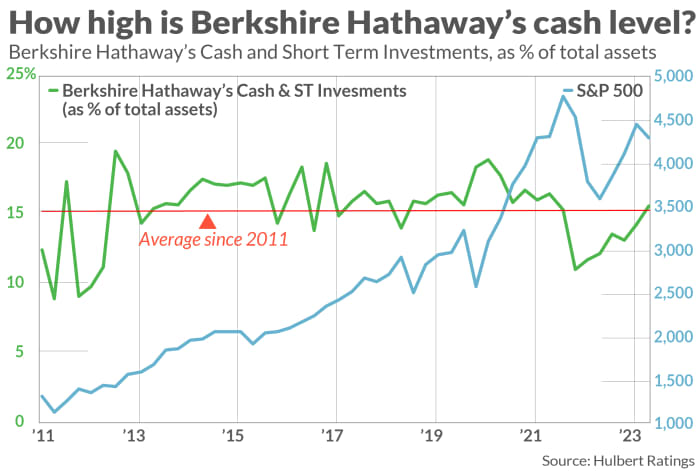

Put in its correct context, nevertheless, Berkshire’s present money level is unexceptional. As a portion of the business’s overall possessions, that level is nearly exactly equivalent to its historic average. Think of it in this manner: Due to the fact that Berkshire has actually grown as a business, a consistent portion allotment to cash translates to a growing dollar quantity kept in money and short-term financial investments. All Berkshire’s broadening money stockpile may be informing us is that the business is larger than it utilized to be.

As you can see from the chart below, though Berkshire’s money allotment hasn’t been continuous, it has actually varied in a narrow variety. Berkshire’s latest allotment– 15.7%– is basically no various than it 15.5% average because 2011.

The chart likewise consists of a plot of the S&P 500.

SPX,

revealing that modifications in Berkshire’s money level are not inversely associated with the marketplace’s ups and downs. Such an inverted connection would exist if Buffett’s allotment to money showed a contrarian response to an over- or underestimated market. Rather, there frequently has actually been a favorable connection in between the 2 series. Throughout 2022’s bearishness, for instance, the money allotment fell– opposite of what you would anticipate on the theory that the allotment shows a growing variety of deals on Wall Street.

This does not imply Buffett is a bad market timer. After all, he does not think in market timing in the very first location. Variations in Berkshire’s money level are mostly due to other aspects unassociated to market timing. The drop in the business’s money allotment in 2022, for instance, mostly showed the acquisition of Allegheny Corp. for $11.6 billion in money

The bottom line? While Warren Buffett might think that the stock exchange is miscalculated, you can’t conclude this from Berkshire’s present allotment to money and short-term financial investments.

A more comprehensive takeaway from this conversation is the worth of embracing a hesitant mindset towards Wall Street assertions. Not all are deceptive, however much of them are– even those that ostensibly appear engaging.

Mark Hulbert is a routine factor to MarketWatch. His Hulbert Rankings tracks financial investment newsletters that pay a flat cost to be investigated. He can be reached at [email protected]

Have A Look At On View by MarketWatch, a weekly podcast about the monetary news we’re all seeing– and how that’s impacting the economy and your wallet. MarketWatch’s Jeremy Owens trains his eye on what’s driving markets and uses insights that will assist you make more educated cash choices. Subscribe on Spotify and Apple