Summary.

Galena Mining Limited (ASX: G1A, Galena) owns 60 percent of the Abra base metals mine situated in the Gascoyne area of Western Australia – home to among the biggest lead and silver deposits on the planet, set to produce the highest-grade, cleanest lead concentrate readily available worldwide. The business is profiting from its Tier 1 possession in a Tier 1 jurisdiction, enhanced by and leveraging collaborations with Japan’s biggest zinc and lead smelter, along with with among the leading base metals trading companies on the planet.

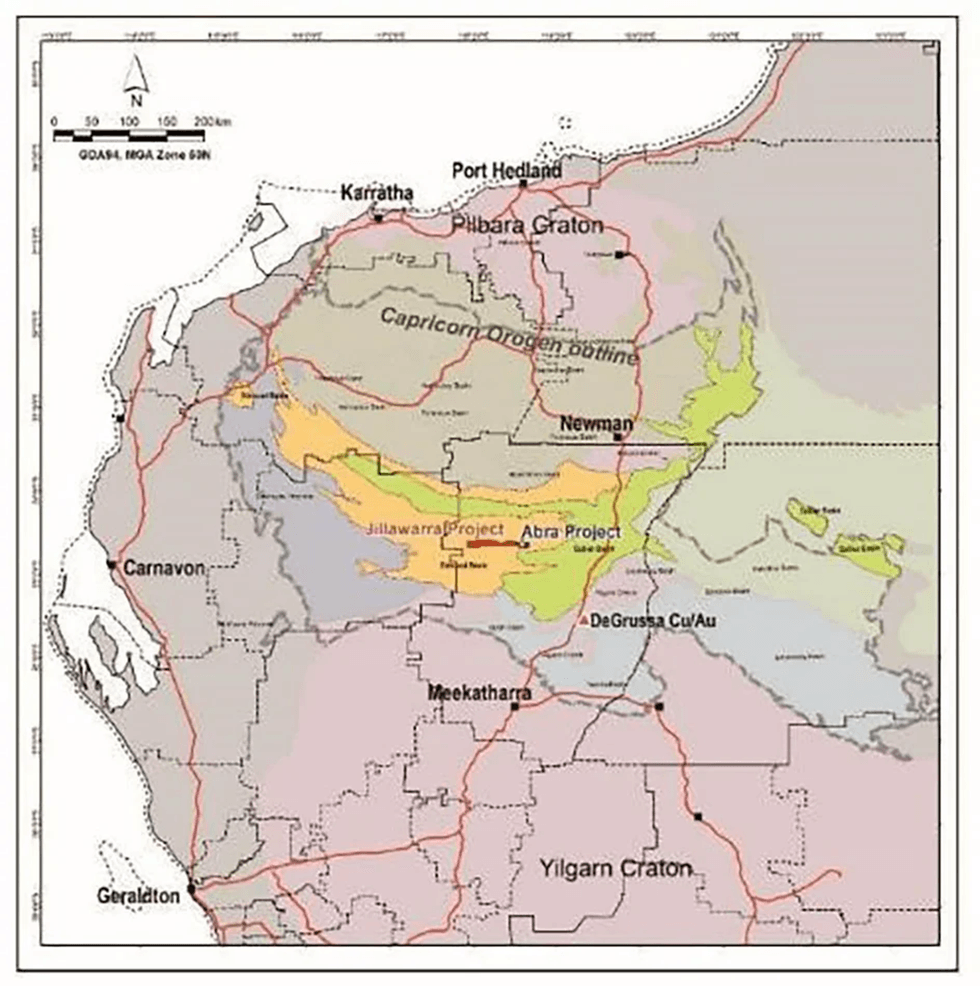

The business likewise owns one hundred percent of the Jillawarra Task, which covers 76 kilometers of strike extension straight to the west of Abra. The Jillawarra Task consists of a number of massive comparable expedition targets consisting of the Woodlands Complex, Quartzite Well and Copper Chert locations.

Galena’s significant collaborations consist of Toho Zinc (TSE:5707), Japan’s biggest zinc and lead smelter, and IXM SA, among the world’s leading 3 base metals trading companies. Toho offered AU$ 90 million task equity and has a long-lasting offtake contract to acquire 40 percent of Abra’s production; while IXM has actually participated in a 10-year take-or-pay offtake agreement to acquire the staying 60 percent.

The business’s management group brings years of experience in the mining and base metals market and has a tested performance history of success throughout all phases of expedition, from advancement to production.

In November 2020, Galena put in location US$ 110 million in settled financial obligation centers organized by Taurus Funds Management. The centers consist of a US$ 100-million task financing center plus a US$ 10-million expense overrun center.

The task financing center includes a 69-month term loan mainly to money capital investment for the advancement of Abra. Secret terms consist of:

- Repaired interest of 8 percent per year on drawn quantities, payable quarterly in financial obligations.

- 1.125 percent net smelter return royalty.

- No compulsory hedging.

- Early payment permitted without charge.

- 15 quarterly payments beginning on 31 December 2023.

The expense overrun center is a loan to fund determined expense overruns on the task in capital investment and working capital. Repaired interest of 10 percent per year uses to quantities drawn under the expense overrun center.

The Taurus financial obligation centers have actually been completely drawn and are protected versus Abra Task properties and over the shares that each of Galena and Toho own in Abra.

Business Emphasizes.

- Placed to understand worth for investors:

- Abra mine building and construction finished in December 2022, on time and on spending plan.

- Very first in-specification concentrate delivery attained in March 2023.

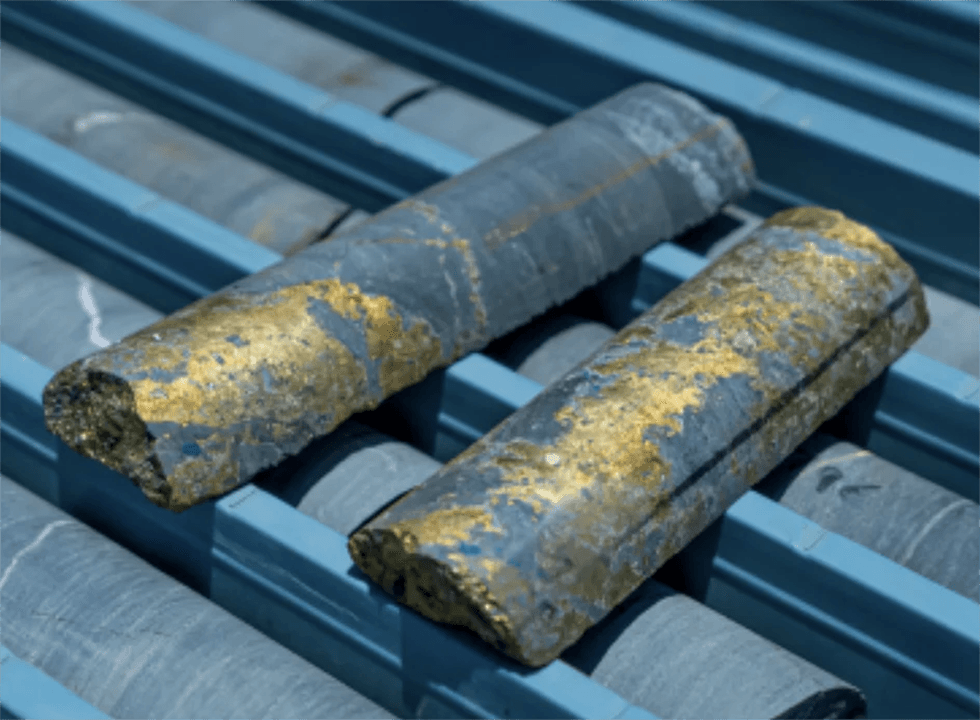

- Abra is among the biggest and cleanest lead-silver deposits on the planet (state-of-the-art, high-value concentrate 1/10th common unhealthy components).

- Amazing expedition ground and understood copper-gold mineralisation listed below the Abra lead-silver deposit.

- JV in between Galena (60 percent) and Japan’s biggest zinc and lead smelter Toho Zinc (40 percent) underpins long mine life (10+ years) in an interesting brand-new mineral province in Western Australia.

- Galena has a 10-year offtake contract with IXM, among the world’s biggest base metals traders.

- Yearly steady-state assistance:

- Mill throughput of more than 1.3 million tonnes per year (Mtpa), producing +90,000 tonnes per year lead and +550,000 ounces per year silver.

- Yearly typical lead C1 direct money expense of US$ 0.55 to US$ 0.65/ pound.

- Yearly typical EBITDA (revenues before interest, taxes, devaluation, and amortization) of AU$ 90 million to $100 million.

- The Abra mine lies in the Gascoyne Area of Western Australia, home to among the biggest undeveloped lead deposits on the planet and the highest-grade lead concentrate readily available, worldwide.

- The Abra mine brings a JORC mineral resource quote (July 2023) of 16.2 million lots (Mt) at 7.3 percent lead and 19 grams per lot (g/t) silver in the suggested classification, and 16.9 Mt at 6.9 percent lead and 15 g/t silver in the presumed classification.

- Abra has actually been called the world’s lowest-cost main lead mine by Wood Mackenzie, a leading mining research study and consultancy group.

- US$ 110 countless task funding financial obligation centers from leading mining-specialist loaning fund Taurus Funds Management.

- Galena’s management group brings years of experience in the mining and base metals market and has a tested performance history of success throughout all phases of expedition, from advancement to production.

Secret Tasks.

Abra Mine

The Abra Mine is a 60:40 joint endeavor in between Galena and Japanese lead manufacturer Toho Zinc. It is an internationally considerable lead-silver task found in the Gascoyne area of Western Australia, in between the towns of Newman and Meekatharra roughly 110 kilometers from the DeGrussa copper mine owned by Sandfire Resources (ASX: SFR).

Abra Mine Website Area

The Abra mine brings an overall JORC mineral resource quote released in July 2023 of 33.4 Mt at 7.1 percent lead and 17 g/t silver (5 percent Pb cut-off grade), that includes 0.3 Mt at 7.3 percent lead and 32 g/t silver in the determined classification; 16.2 Mt at 7.3 percent lead and 19 g/t silver in the suggested classification; and 16.9 Mt at 6.9 percent lead and 15 g/t silver in the presumed classification.

All authorizations for the Abra task have actually been gotten from the suitable Western Australian regulative bodies. The task is likewise based on a current land usage and heritage contract with the Jidi Jidi Aboriginal Corporation. The Abra home is well-serviced by public roadways and highways, and all the needed facilities has actually been established to carry lead-sulphide focuses to the Port of Geraldton, Abra’s main export port.

Abra Processing Plant

A last financial investment choice to finish the Abra Task was made in June 2021 and building and construction was finished in December 2022, on time and on spending plan. A number of essential turning points were attained in the March 2023 quarter, consisting of the commissioning of the processing plant, very first ore fed into the plant and very first concentrate produced in January 2023.

The processing plant attained in-specification concentrate production from the start of concentrate production and throughout the 2023 fiscal year, 967,622 lots of ore was processed and 61,800 lots of lead concentrate was produced.

The business is presently carrying out comprehensive technical work to establish an upgraded production prepare for 2024 production targets and assistance.

Jillawarra Task

Expedition and development related to the one hundred percent Galena-owned Jillawarra Task covers an extremely potential lengthened tenement plan covering roughly 76 kilometers of constant strike length and 508 square kilometers straight to the west of Abra.

The Jillawarra Task hosts numerous base metals potential customers which have actually had restricted shallow expedition work finished considering that the 1970s by different business. The bulk of the expedition work was finished by Amoco, Geopeko, Peak Minerals and Abra Mining Limited. The work finished to date has actually determined a number of base metals, manganese and gold potential customers, of which the Woodlands Complex, Quartzite Well, Manganese Variety, Copper Chert, TP and 46-40 underwent early-stage expedition. The majority of the drilling finished within the Jillawarra Task examined the very first 100 to 200-meter depth which, based upon current understanding of Abra, might not have actually reached the depths needed.

The primary potential passage within the Jillawarra Task lies within the margins of the Quartzite Well– Lyons River Fault zones which extend east-west along the whole tenement plan. Likewise, the contact in between the dolomitic sediments of Irregully Development and the lower sedimentary system, polymictic corporation, of the Kiangi Creek Development represents a crucial marker for the incident of base metal mineralisation as seen at Abra.

The Woodlands Complex is an Australian scaled geophysical abnormality which represents a substantial target location with the abnormality being 12 kilometers long and 10 kilometers broad. Minimal work and technical examination have actually taken place at Woodlands which provides a fantastic chance for Galena in the years to come. Continuous geophysical and expedition drilling will take place simultaneously with the advancement of Abra. The understanding and understanding of Abra due to its advancement will offer a substantial expedition benefit at Jillawarra.

Management Group.

Tony James– Handling Director and CEO

Tony James is a mining engineer with over thirty years’ mine operating and task advancement experience mainly in Western Australia. He likewise has previous experience at handling director level of 3 ASX-listed business with 2 of those business effectively directed through a merger and takeover procedure benefiting the investors. He has a strong mine operating background (examples being the Kanowna Belle cash cow and the Black Swan nickel mine) and a strong expediency research study/ mine advancement background (examples being the Pillara zinc/lead mine and the Trident/Higginsville cash cow).

Adrian Byass– Non-executive Chairman

Adrian Byass has more than 25 years of experience in the mining market both in noted and unlisted entities worldwide. He has actually acted as non-executive and executive director of different noted and unlisted mining entities, which have actually effectively transitioned to production wholesale, valuable and specialized metals worldwide. He presently serves on the boards of ASX gold, base metals and lithium business.

Neville Gardiner– Non-executive Director

Neville Gardiner has more than thirty years of experience recommending boards on mergers and acquisitions,

equity and financial obligation capital markets, deal structuring, capital allotment and complex

industrial plans. His profession accomplishments consist of senior executive management

functions in Deloitte, Torridon Partners, and at Bank of America Merrill Lynch, where he invested 5 years as the head of its Australian Natural Resources Group. He likewise invested 9 years with Macquarie Bank, where he had obligation for its Western Australian Business Financing company and its Australian Oil and Gas Advisory company. He has a really strong experience and understanding base related to the resources sector in Australia.

Stewart Howe– Non-executive Director

Stewart Howe has more than 40 years of experience in the worldwide resource market consisting of 18 years in mining. He was primary advancement officer at Zinifex, among the world’s biggest miners and smelters of lead and zinc. He led the spin-off of Zinifex’s smelters to develop Nyrstar NV, and rebooted the advancement of the Dugald River mine.

Craig Barnes– Chief Financial Officer

Craig Barnes has more than 25 years of experience in senior financing and monetary management within the mining market and formerly the monetary services market. He has significant experience in task funding, mergers and acquisitions, joint endeavors, treasury and application of accounting controls and systems.

Before signing up with Galena, he held the position of CFO of Paladin Energy for more than 5 years and became part of the group that effectively finished the business’s capital restructuring in 2018. Prior to that, he was the primary monetary officer of DRDGOLD (NYSE and JSE: DRD) and its associated subsidiaries for more than 7 years.

Aida Tabakovic– Business Secretary

Aida Tabakovic has more than 11 years of experience in the accounting occupation, that includes monetary accounting reporting, business secretarial services, ASX and ASIC compliance requirements. She has actually been associated with noting a number of junior expedition business on the ASX and is presently business secretary for various ASX-listed business