Options agreements connected to more than $5 trillion worth of stocks, exchange-traded funds and indexes are set to end on Friday as the most recent “triple witching” expiration occasion hits the rebalancing of the S&P 500 and Nasdaq-100.

The outcome might be a high-octane, and possibly incredibly unstable, session where 10s of billions of agreements and shares might alter hands, market strategists stated.

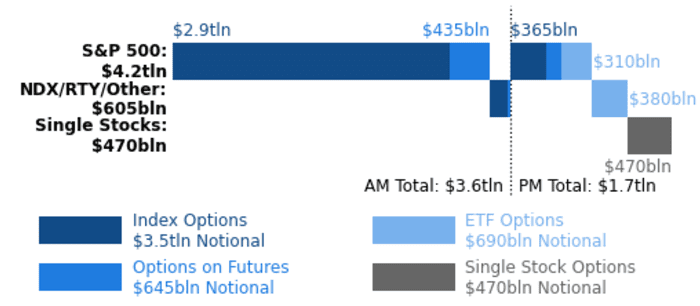

According to figures from Rocky Fishman, creator of Asym500, alternatives with a notional worth of $5.3 trillion are set to end, with the greatest slug ending ahead of the open.

ASYM50

On one side, lots of traders will be moneying in bullish bets that are deep in the cash, while some roll their positions, requiring market-makers to continue to hedge their direct exposure.

At the very same time, supervisors of index-tracking funds will require to end up changing their holdings before the revealed index modifications work.

Currently, trading volume has actually been trending greater all week. In the U.S. market, 17 billion shares altered hands on Thursday, according to Steve Sosnick, primary market strategist at Interactive Brokers, throughout a phone interview with MarketWatch. That is up from 10.6 billion on Tuesday.

” I anticipate to see huge volumes tomorrow in a great deal of popular names,” Sosnick stated.

” Not just will this one be the biggest alternative expiration of the year (as is common for December), however it is presently established to end up being the biggest SPX alternative expiration in more than a years,” Fishman stated in a report shown MarketWatch.

Brent Kochuba, creator of Spotgamma, an options-market analytics supplier, went even further throughout a phone interview with MarketWatch: “This may be the greatest alternatives expiration ever.”

ASYM50

As markets have actually rallied, traders have actually been scooping up bullish alternatives agreements at a record speed, according to information from Cboe Global Markets, the greatest operator of alternatives exchanges in the U.S.

For S&P 500-linked alternatives, normally the most popular item, 4.8 million agreements altered hands on Thursday, according to Cboe, a brand-new record, going beyond the previous record from Nov. 14.

Likewise, overall call-trading volume for all U.S. equity alternatives surpassed 30 million agreements on Wednesday, according to Goldman Sachs Group, making it among the busiest days for trading in bullish agreements this year.

Aggressive call-buying over the previous month has actually assisted press the S&P 500 to simply shy of its record closing high, options-market specialists stated. The S&P 500

SPX

acquired 8.9% in November, its finest month of 2023, and the 18th best-performing month of the previous 73 years. And it has actually continued to climb up in December, having actually increased 3.3% through Thursday’s close, according to FactSet information.

Previously today, alternatives strategists cautioned that markets may face problem at 4,600 on the S&P 500. They cautioned that a “call wall” of open-interest in bullish agreements around that level might require market makers to put the breaks on the rally.

Rather, bullish traders blew through the call wall, pressing it greater to 4,700, stated Kochuba.

The S&P 500 closed at 4,719.55 on Thursday, its greatest close considering that Jan. 12, 2022, according to FactSet information. The index is now sitting within 1.75 portion points of its record closing high of 4,796.56 on Jan. 3, 2022.

Traders’ bullishness just recently assisted press the Cboe Volatility Index.

VIX,

otherwise referred to as Wall Street’s “worry gauge,” to multiyear lows, according to FactSet information.

To be sure, it isn’t simply S&P 500 alternatives and agreements connected to popular stocks like Tesla Inc.

TSLA,.

seeing explosive volume: Calls connected to the iShares Russell 2000 ETF.

IWM,

which tracks the small-cap Russell 2000, struck 1.35 million agreements, the third-highest ever, according to Goldman. Activity in alternatives agreements connected to small-cap stock indexes has actually risen considering that late October.

Heavy call purchasing has actually pressed the put-call alter for S&P 500 alternatives to its most affordable level in a year, according to information from Goldman Sachs Group.

This reveals that financiers have actually been rushing to purchase bullish agreements, while mostly avoiding bearish ones, as stocks marched greater. Goldman experts explained Friday as “the last significant liquidity occasion of the year” in a note to customers gotten by MarketWatch.

GOLDMAN SACHS

” Triple Witching” days occur when a quarter. They are thusly called since alternatives connected to single stocks, ETFs and indexes will end, along with index-tracking futures agreements. Options-market specialists state they are normally related to more intraday swings and greater trading volume.

Making things much more fascinating is the reality that the quarterly rebalancing of the S&P 500 and Nasdaq-100 is because of work after markets close on Friday.

Usually regular, this quarter’s rebalancing is drawing outsize attention following an incredibly unusual advertisement hoc rebalancing over the summer season to control the impact of megacap stocks in the Nasdaq-100.

Previously this month, Requirement & & Poor’s revealed its rebalancing strategies, that included lowering the weighting of 2 Splendid 7 stocks, Apple Inc.

AAPL,.

and Alphabet Inc.

GOOG,.

GOOGL,.

At the very same time, Amazon.com Inc.

AMZN,.

which is likewise part of the Mag 7, will see its weighting increased. On the other hand, 3 business will sign up with the index, consisting of Uber Inc.

UBER,.

while shares of 3 other business leave.

Kochuba thinks Friday’s expiration might get rid of the last barrier holding stocks back from soaring to tape highs before completion of the year.

” After OpEx, markets will have the ability to move more easily,” Kochuba stated.

Garrett DeSimone of OptionMetrics warned that financiers should not put excessive weight on options-market activity and other technical elements.

” At the end of the day, macro exceeds whatever,” he stated throughout an interview with MarketWatch.

.